back after a long weekend.

mkt doing its bit to move up towards the 5182 mark. but is that enough. its still in that range 4800-5200 and needs to break above that convincingly.

many resistances are lying up on the upperside like 5250/5300/5545 etc which it will have to overcome. couple of strong closes above 5183 will be better, there is some possibility on the short term daily charts to achieve this.

nifty spot support 4920 sl 4850.

|

| RSS blog feed url: http://feeds.feedburner.com/Valuetrading |

past short term calls follow-up/performance***(stocks to watch)

date,stock,reco price,high,% gain at high

***all analysis are based on self chart study only, actual trading gains may vary.

Twitter nifty intraday trading Updates

Tuesday, December 29, 2009

29th dec 2009...

Posted by

abhay r somkuwar

at

7:18 AM

4

comments

![]()

Friday, December 25, 2009

merry christmas and happy new year greetings to all..

Posted by

abhay r somkuwar

at

4:03 AM

2

comments

![]()

Sunday, December 20, 2009

nifty view...market ahead...

nifty is currently in near and short term downtrend. it is still weak and personally i feel going forward it may be headed, with some bounces, to near above 4800 lvls if not supported by positive global cues, may form a short term bottom on tuesday, it would be better to play by lvls.

monday intraday resis 5020(would be near term bullish above this till 5130 etc), support 4940.

short term resis 5130, above it would be bullish till 5183.

short term supports 4935-4950. but if broken then below 4930 short term downside would get open till 4810 may get supported near 4830-4850.

Posted by

abhay r somkuwar

at

12:23 PM

0

comments

![]()

Thursday, December 17, 2009

mkt ahead 17th dec 2009...

nifty still bearish in near term downtrend, but in intraday nifty bounced off oversold lvls near 5000.

as such its possible to reach 5100/5120-5130 intraday if stays bullish above 5070 for sometime.

supports are 5010, sl 5000. opening may be slightly negative.

the near to short term trend may turn up if nifty spot closes today above 5080.

Posted by

abhay r somkuwar

at

9:29 AM

0

comments

![]()

Wednesday, December 16, 2009

Tuesday, December 8, 2009

follow up:perfect play, nifty intraday lvls...

this was said yday,

"trading lvls for intraday nifty traders, if nifty crosses intraday and stays above 5118 can tgt upto 5161/5181. support 5088/5080, below which chances of weakening upto 5050/5020."

now pls refer the above charts points m,n and o. nifty couldn't sustain above 5118 and thereafter dropped till 5080 where it bounced but only to break below it and took support on 5050 where it bounced off quite well afterwards(i.e today in intraday).

perfect play!!!:)

Posted by

abhay r somkuwar

at

11:43 AM

2

comments

![]()

Monday, December 7, 2009

mkt ahead 07th dec 2009...

in the last posts it was said that,

"however 4880 was held on closing basis, and in the very near term any bounce nifty may possibly get restricted to 5012/5030. so the near term range is about 4800 to 5030."

"a few closings above 5030 if supported by global mkts, the nifty would be again more bullish to reach the previous high of 5182, if any profit booking comes and gets limited to 4880/4860"

however the range 4800-5030 was broken on upperside in the early part of last week, 4860/4880 was held and hence nifty continued and achieved the tgt lvl of 5182.

its now important for nifty to cross and close above 5182 for some days atleast to achieve the short to medium term tgts of 5300/5400/5545 etc. support lvl 4880/4800. below it gets bearish upto 4700/4538.

trading lvls for intraday nifty traders, if nifty crosses intraday and stays above 5118 can tgt upto 5161/5181. support 5088/5080, below which chances of weakening upto 5050/5020.

Posted by

abhay r somkuwar

at

8:24 AM

0

comments

![]()

Sunday, December 6, 2009

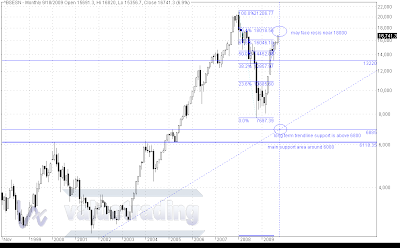

my gold ew chart...

as per london gold prices.

gold is in correction mode.

rough tgts for the fives could be about $1300/$1540, subject to chnage as per scenario unfolding. downside lvls for internal waves as shown on the chart above.

right now one or two degree's correction may be happening, this is monthly chart the movement therefore would be clearer after sometime.

once wave five is completed, a big correction can come to below $1000 maybe in that range $700-$1000.

pls note that this is as per london gold prices which are on closing spot basis, which is different from nyse or comex gold futures prices.

gold chart all data.

on nyse gold the downside/support lvls are 1100/1070/1030/990.

mcx gold futures with trendline's supports.

Posted by

abhay r somkuwar

at

2:55 PM

3

comments

![]()

Monday, November 30, 2009

testing times!!!, mkt ahead 30th nov 2009...

after a long time the negative correlation between the global equities and the us dollar index gets disturbed, and asian mkts particularly seen correction on dubai debt payment delays in real estate sector giving doubts on economic recovery in that part of the world and indian listed shares of companies having operations in west asia getting a good amount of beating. fii's are continously turning out to be net sellers in cash in large amounts.

technically, i had said mkt was losing momentum and we could get a whipsaw/volatility, and that's what we are seeing. near term positional long traders are already out on break of 5030/5000 and hence got protected from the further 200 point fall.

the imp 4880/4900 lvl was broken but mkt saw recovery by the close of the day above that lvl. 4800 at the moment, from options data, looks as the near term support but after a pullback some more weakness may still be left.

it may be noted that 4550/4350 are very crucial medium to intermediate term support lvls if the nifty is to tgt 5300/5400 and any breaking of those lvls will make it that much more difficult, though not impossible, for nifty to achieve the higher tgts. at the moment iam still optimistic on the higher tgts in the intermediate term.

however 4880 was held on closing basis, and in the very near term any bounce nifty may possibly get restricted to 5012/5030. so the near term range is about 4800 to 5030.

Posted by

abhay r somkuwar

at

12:45 AM

0

comments

![]()

Sunday, November 22, 2009

mkt ahead 23rd nov 2009...

lets first have a look again at my nifty p/e chart with the circle marked providing resistance to the upmove(profit booking line).

from the last two posts,

Monday, November 9, 2009:

"to establish a stronger uptrend, the nifty has to move and stay above 4854-4864, if that happens then chances of touching 4937/5030 could be there, since the us dollar index is still supportive of some more of the rally in the global equity mkts continuing."

Monday, November 16, 2009:

"if nifty stays sideways to up for a some more days then a firmer uptrend may get established.

a few closings above 5030 if supported by global mkts, the nifty would be again more bullish to reach the previous high of 5182, if any profit booking comes and gets limited to 4880/4860."

nothing more to add, the profit booking/whipsaw did come and got limited above 4880/4860, also the tsl for longs as always was excellent enough to protect the positions.

nifty is losing momemtum but seems moving toward 5182 in the current upmove, once small resistances 5080/5110.50 are crossed, if the global scenario remains stable. thereafter tgts of 5250/5300/5388/5500 etc would be still open as long as the medium to intermediate trend remains up and any profit booking gets limited to 4880, iam not expecting anything more on the upper side beyond that. for monday the tsl for short term positional longs to be raised to 4990 closing basis.

nifty spot eod chart:

nifty needs to remain at least sideways or up, lets say above 4880, for a bullish crossover again of 20 dma and 50 dma, macd already had made a bullish crossover earlier.

fii's been net sellers in cash last couple of trading sessions/days.

Posted by

abhay r somkuwar

at

6:41 PM

1 comments

![]()

Monday, November 16, 2009

16th nov 2009...

4854-4864 was crossed on first day and held thereafter we saw nifty getting to the first tgt, and second tgt 5030 nearly done.

if nifty stays sideways to up for a some more days then a firmer uptrend may get established.

a few closings above 5030 if supported by global mkts, the nifty would be again more bullish to reach the previous high of 5182, if any profit booking comes and gets limited to 4880/4860.

for today positional longs can raise the tsl to 4840.

all prices are on closing basis.

Posted by

abhay r somkuwar

at

8:56 AM

0

comments

![]()

Monday, November 9, 2009

mkt ahead 09th nov 2009...

earlier the nifty bounce came off from exactly near 4540 which was sl lvl on range brkout that was on my radar and thankfully not broken on downside and got supported else it would have gone toward 4400 etc. allright, so the near term and near to short term trend are up but still nifty is not out of the woods as the macd and other indicators are still in negative territory. one can have a tsl such as 4740 and 4720 respectively for the longs, since chances of whipsaw are not ruled out.

nifty is still trading below the 20dma which is currently 4931 which may act as resis. to establish a stronger uptrend, the nifty has to move and stay above 4854-4864, if that happens then chances of touching 4937/5030 could be there, since the us dollar index is still supportive of some more of the rally in the global equity mkts continuing.

Posted by

abhay r somkuwar

at

10:40 AM

0

comments

![]()

Tuesday, November 3, 2009

mkt ahead 03rd nov 2009...

back from the inauguration of beautiful and huge jungle and hill resort of one of the relatives located on mstate-mp border during the weekend. didn't get much time to update the blog.

well this is yet again a shortened week in our stock mkt.

the short/medium trend decider lvl of 4900(with 5000 tsl) given earlier got convincingly broken on the downside, setting that trend downward. sharp selling by the fiis and shorting has led nifty not holding to the lvls of 4740/4790 too and still its weak upto 4580 in the near term. in the short to medium term the downside has opened upto 4360/4400. this doesn't mean that it really has to go and test those lvls. we had gone into small reversal on equity and usd in the short term but not any major one, so the major upside tgts are still intact in the intermediate term as long as the big supports 4350 and 3900 are held. weekly resis is 4872 which needs to be crossed for near term uptrend. fiis and dii net positive cash figures to the tune of Rs. 500 odd crores each however were quite encouraging.

refer to reliance swing chart given earlier posts, it is trading quite near to the lvls of 1928/1866 marked on the chart, where it may find some good support.

all lvls mentioned are on closing basis.

Posted by

abhay r somkuwar

at

7:52 AM

0

comments

![]()

Wednesday, October 28, 2009

nifty ahead...in for a bounce?

Posted by

abhay r somkuwar

at

6:56 AM

0

comments

![]()

Tuesday, October 27, 2009

some welcome nse website new features...

live market map(on the lines of moneycontrol market map):

Posted by

abhay r somkuwar

at

8:41 PM

0

comments

![]()

Monday, October 26, 2009

mkt ahead...

nifty closed at 4997.05 slightly below 5000 lvl but above the support tline. staying above closing 5054 will be better as the trendline from march low gets broken below that. however as pointed out earlier 4900 is a strong support for maintaining the short to medium term uptrend and should not be broken else further bearishness will come upto 4740/4790. my ew tgt 5142 already done. other technical tgts are 5250/5300/5388/5545 which nifty will try to achieve if the major supports on nifty chart are held in the medium to intermediate term. however in the near term nifty looks rangebound in 4900-5100 and a small bounce from 4945 lvl is quite possible.

Posted by

abhay r somkuwar

at

2:37 AM

0

comments

![]()

Thursday, October 22, 2009

three charts of a perfect reliance swing trade...

Posted by

abhay r somkuwar

at

8:02 AM

0

comments

![]()

Saturday, October 17, 2009

diwali special stocks to watch and invest...

apart from all the stocks to watch recomm given in last few months, many of which are already giving good returns, here's some of my stock picks for medium to intermediate term.

buy on dips for atleast 20-30% returns***.

aban offshore,

larsen and toubro,

bgrenergy,

ivrclinfra,

idbi,

nagajuna const,

orchid chemicals,

powergrid,

cesc,

relcapital.

many banking stocks like andhra bank and realty stocks like dlf and hdil, oil stocks like essaroil and ongc, some it stocks like hcl-insys, metal stocks like hindalco, ster, sail, engg like laxmimachines and it education stocks like niitltd etc may continue to move up if money flow into mkt and stocks continues.

(***not for immediate gains, for those traders/investors with patience, and only if mkt supports, suggested to have a decent stoploss, pls read disclaimer given above)

Posted by

abhay r somkuwar

at

11:59 AM

5

comments

![]()

दीपावली की हार्दिक शुभकामनाएं !!!!!

Posted by

abhay r somkuwar

at

3:38 AM

6

comments

![]()

Friday, October 16, 2009

16th oct 2009...

as given in 12th oct 2009 post nifty bounced from the support tline, reacted intraday from first resis line and then did a brkout from both the resis lines. it was also clearly mentioned that short term will be bullish above 5025 close and nifty thereafter reached upto intraday high of 5152, which was also our tgt as per ew analysis on eod charts.

the us dollar index still continues its downward journey which is helping the rally in global mkts.

positional longs are intact since 4630 and 4900 acted as safe and imp sl. presently sl for short term positional longs is 5000.

intraday trading lvls: in intraday it was weak yday and if mkt is not able to sustain above 5120 then can test supports at 5077/5065, lvls below which are 5040 and 5012. above 5120 it can go to 5152 brking above which can go upto 5200/5250 in near term.

Posted by

abhay r somkuwar

at

8:44 AM

0

comments

![]()

Wednesday, October 14, 2009

poll results...

the dow jones poll on the blog is closed. this is ur(reader's) final opinion about what u feel how the movement in the dow jones is likely to be from hereon. remember i had asked for very long term dow movements here and not short term movements. i had not voted on this poll since i had given my opinion(case II, suprisingly its the one attracting least attention:)). thanks to everyone who participated, it helps to get some idea of how the readers view the global scenario.

case V: dow will not go down below march 2009 lows and will not go beyond 2007 high(40% respondents in favour).

case I: march 2009 lows are final and 2007 high will be taken out(18% respondents in favour).

case IV: dow will go down below march 2009 lows, get supported on/above trendline support, move up but not cross 2007 high(15% respondents in favour).

case II: dow will go below march 2009 lows but get supported on lower trendlines and move up above 2007 high(12% respondents in favour).

case III: dow will go down below march 2009 lows and go down below trendline support(12% respondents in favour).

closing the blog is a difficult decision for me. the main objective of utility of technical analysis in judging the market has been met with a very good success. hence intially, from 20th of october 2009 i won't be able to update the blog on a regular basis, say once every two weeks. some features like the calculators will be disabled since the site where they are hosted will be going down.

thanks.

Posted by

abhay r somkuwar

at

10:12 PM

0

comments

![]()

Monday, October 12, 2009

mkt ahead...

as said earlier nifty is already in a near to short term profit booking downtrend but had not broken any imp support lvl. sustaining a close above 5025-5030 can set that trend to up again.

however 4900 is key lvl which has acted as a very good support, a brk on closing of which chance of nifty sliding another 100 odd points.

nifty closed below thursday low so a bit weak. however it also closed very near/above the support tline from march lows. hence might give a small bounce, to be resisted by falling resis lines on upperside near 5000 and 5040.

on hourly chart its moving in a triangle-like pattern. one may either play swing within the triangle or wait for brkout/brkdown.

safe sl for short term posi longs 4900, tsl for intermediate term 4860 closing basis, if the index remains rangebound profitable/tradeable stock specific moves can occur due to the result season going on.

Posted by

abhay r somkuwar

at

6:00 AM

2

comments

![]()

Sunday, October 11, 2009

Tuesday, October 6, 2009

mkt ahead...

lots of stocks are showing large upside potential in medium to intermediate term, but all depends on mkt whether it holds or breaks down. as for now no major lvl on downside has been breached and even the short term trend is still up. so as of now no sign of bearishness in the short term, looks like some profit booking is happening, for now 4900 is a good support lvl.

for short term positional long traders tight sl 5000 and 4900 as safer one. intermediate cash/portfolio traders and longs can keep tsl below 4800(4800-4830 currently support zone). all lvls closing basis.

nifty p/e chart:

Posted by

abhay r somkuwar

at

7:39 AM

4

comments

![]()

Tuesday, September 29, 2009

mkt ahead 29 sep 2009...

another back to back long weekend is over and we are starting afresh to trading the mkts.

european and american mkts closed in the green and asia-pacific mkts also are trading with gains.

nifty short term trend is still up(since 4630) despite small correction last week, short term players can keep a cl sl at 4900. while intermediate longs and medium to intermediate term investors can raise their cl tsl to 4750.

we are in a new series and hopefully nifty might make a new high, tgts given earlier. on any weakness tsl should be followed for protecting the profits.

thanks for participating in the poll, do keep voting as the dow poll is open for another 14 days.

Posted by

abhay r somkuwar

at

6:27 AM

2

comments

![]()

Sunday, September 27, 2009

poll: dow macro timeframe chart(ew)...

dow jones chart since the early 1930's. i have marked my preferred supercycle and primary wave counts for projecting the likely direction.

please participate in the poll, given below as well as on the right hand sidebar, to give ur own opinion about what u feel how the movement in the dow jones is likely to be from hereon.

case I: march 2009 lows are final and 2007 high will be taken out.

case II: dow will go below march 2009 lows but get supported on lower trendlines and move up above 2007 high.

case III: dow will go down below march 2009 lows and go down below trendline support.

case IV: dow will go down below march 2009 lows, get supported on/above trendline support, move up but not cross 2007 high.

case V: dow will not go down below march 2009 lows and will not go beyond 2007 high.

poll: dow jones will move as per following... |

Posted by

abhay r somkuwar

at

10:56 AM

0

comments

![]()

Thursday, September 24, 2009

Tuesday, September 22, 2009

mkt ahead 22nd sept 2009...

short term positional longs tsl for today 4844 closing basis, intermediate term nifty tsl for cash portfolio/longs 4670 closing basis.

earlier given nifty tgts 4970/5300, had also suggested booking partial profits in longs above 4900 and rest to be carried with appropriate tsl.

stocks to watch medium term investment:

shipping stocks like abg and bharti, auto ancillaries like amtek, small it education related like aptech, smaller psu banks like andhrabank etc, they may see action with small corrections in between if mkt trend remains up or stable.

Posted by

abhay r somkuwar

at

7:17 AM

0

comments

![]()

Sunday, September 20, 2009

my sensex ew chart...

similar nifty ew analysis gives tgt of the upmove(with in between smaller corrections) upto 5142(say 5200).

that may happen during next month if the support tline is not broken on the downside.

Posted by

abhay r somkuwar

at

8:36 AM

0

comments

![]()

Saturday, September 19, 2009

Thursday, September 17, 2009

some index stock charts...

acc chart, cement sector stocks are moving up now.

hdil chart, brkout from 327, upper resis/tgt 400 but may face intermeditae resis by upper tline as shown above.

ifci had broken out but became sluggish as its getting resisted on the upperside.

reliance brkout and swing chart.

Posted by

abhay r somkuwar

at

10:12 PM

0

comments

![]()

Wednesday, September 16, 2009

Sunday, September 13, 2009

market view: then, now and going forward...

lets rewind a bit...

from intraday ew counts we had concluded the previous short term upmove will get over around 4700 odd followed by a decline to 4580(4570 as support) or so and if not held then only a decline to 4500-4550 where again it will be a buying opportunity for next upmove to 4900 etc which will act as a good resis going forward. a nifty range chart was also put up with clearly marked brkout(4755)/down(4527)lvls. months ago we had projected dollar index to be bottoming in 75-77 range.

what has actually happened...

reaction came in below 4750 followed by downmove getting supported just above 4570, followed by upmove till just below 4900 where it got reacted again, everything just as per expectations. in between a bullish brkout from 4755 also has taken place.

also noteworthy is nifty has already retraced 61.8% of entire downmove from 6357 to 2253 and has closed above it. the us dollar index its there in projected range 75-77 already but still no sign of any reversal taking place, good for the equity mkts.

what to expect...

as said so many times before, nifty is nearing its bear mkt peak/bull mkt profit taking valuations of 22 times eps which comes to around 4900 which remained our tgt for a long time, its nearly done. technically since nifty is on a bullish brkout can go to 4970 or even 5100/5300/5500(i.e., 4700+800) as many are expecting. a touch of euphoria may be setting in.

so what to do?...

those lvls may or may not come immediately. so far, apart from the negative divergences we can see no bearishness either in nifty chart or the US or global indices incl the dollar index etc. but who knows if a reaction can come any time suddenly and sharply then what. some small profit booking can be done in medium to long term investment. the best way is to align with the uptrend and keeping a sl such as just below the intermediate support trendline for longs(including remaining portfolio cash longs), around 4600 cl basis to protect them. current support is seen near 4700 lvl.

icicibank is on a brkout, once it starts trading/closing above 835 can head towards 1000, while hdfc is on the verge of brkout from triangle. in line with mkt many stocks are maintaining the uptrend. need the mkt to be up or atleast stable for the stocks to perform in short to medium term.

(pls read the disclaimer)

Posted by

abhay r somkuwar

at

6:37 PM

2

comments

![]()

Wednesday, September 9, 2009

Monday, September 7, 2009

07th sept 2009...

weekly ranged, resis 4755/4970/5300 supports 4618/4527.

very near term trend is up above 4630.

if by chance anyone bought and still holding hdfc,ifci,recltd and mindtree(http://valuetrading.blogspot.com/2009/06/nifty-june-24th-2009.html) may keep an eye on nifty upward direction/resistances and book at appropriate turning lvls.

hdfc is consolidating sideways in a triangle. ifci has done a brkout on upperside with tgts/resis 66/72. recltd sl 178 cl basis. mindtree resis 588/614.

mkt opening expected in positive.

Posted by

abhay r somkuwar

at

9:43 AM

4

comments

![]()

Sunday, September 6, 2009

nifty charts with supports and resistances...

nifty eod charts, trading in a narrow range.

nifty weekly chart, intermediate trend still intact, upper and lower range limits clearly seen, can be large move if brks out of these.

Posted by

abhay r somkuwar

at

11:37 AM

0

comments

![]()

Friday, September 4, 2009

some interesting and imp stocks to watch...

would be interesting to watch the movements of stocks in coming days, some of which are illustrated below.

RELIANCE:

INFOSYS TECHNOLOGIES:

TECH MAHINDRA:

HDIL:

(click images to enlarge them)

Posted by

abhay r somkuwar

at

7:16 AM

0

comments

![]()

Thursday, September 3, 2009

brkout in mcx gold(update)...

last time i had mentioned mcx gold would be bullish above 15000 and the tgt could be even 15600 etc.

my mcx gold chart is shown above. gold has broken out of the big ascending triangle few days ago.

the supports, resistances and sl lvls are given on the chart.

as always the chart image has to be clicked for a larger image for viewing the details.

Posted by

abhay r somkuwar

at

9:15 AM

0

comments

![]()

Tuesday, September 1, 2009

01st sept 2009...

today's tsl 4620(closing basis) for longs initiated between 4400-4450. intraday or eod below 4620 nifty may get weak upto 4570/4520(tline). weekly support 4450. 4350 closing sl for medium to intermediate term longs.

all the sugar stocks were up yday in falling mkt and are looking attractive in near term.

Posted by

abhay r somkuwar

at

7:56 AM

5

comments

![]()

Thursday, August 27, 2009

market medium term roadmap...

s&p500(us) eod chart with negative divergences and support trendlines:

dow jones eod chart with negative divergences and support trendlines:

sensex weekly chart with negative divergence and support trendline:

nifty weekly chart with negative divergence and support trendline:

strong uptrend on s&p500(us) and dow jones eod charts.

uptrend also is on nifty and sensex charts.

but profit booking or correction is warranted in short to medium term to mentioned lvls/lines.

but given negative divergences appearing on all the above charts, if the trendlines are broken on downside if profit booking comes in, then the lvls upto which they may come down are also marked on the charts.

so given the above and from intraday ew counts, the medium term roadmap scenario to me looks like this. nifty may move in a fashion like correcting to 4500/4550 from 4700 odd and then moving up to around 4900 etc in the next series. similar can also be inferred from options data. 22 p/e also comes around 4900 tgt where it becomes expensive for a bear mkt rally. if nifty does a weekly brkout on upperside then tgts will be higher but i won't consider till that happens.

lets see how it goes, but any dip to support trendline holding would be a buying opportunity.

Posted by

abhay r somkuwar

at

10:04 AM

5

comments

![]()

Wednesday, August 26, 2009

exit closing lvls for nifty...

nifty is in uptrend so pls be with the trend, looks headed toward 4700 or previous top 4731.

exit only when,

weekly closes below 4350.

daily closes below 4465.

intraday ew chart suggests still in intraday uptrend with momentum falling so caution advised for longs as price moves up towards tgt will start getting weak below 4580.

(posted today morning 09:30 am)

====================================

(update afternoon 02:00 pm)

intraday currently looks like 5-iv under progress and last wave 5-v remains.

after that profit booking may come, and initially gets intraday bearish if comes below 4532 and stays then can become weak and come down upto 4580.

below which its into correction mode to 4500.

Posted by

abhay r somkuwar

at

8:49 AM

1 comments

![]()

Tuesday, August 25, 2009

nifty intraday ew(update)...

3-iv and 3-v progressed on expected lines after yday 1.30 pm.

while on the charts its not weak but due to asian mkts trading with negative bias the opening may bring it down and open the expected a flat type 4th wave tgting 4595 (at most 4558 if only stays below that for sometime).

thereafter we may expect a bounce to yday high or more in a couple of days.

why i said my ew counts are speculative because iam projecting a scenario that may or may not unfold, but likely as per my study.

(posted today morning 09:22 am)

=============================================

3:15 pm update(closing bell):

excellent again. from ew views/counts nifty scenario unfolded and has moved exactly as per expectations opening down and reacting from the given lows, looks like the fifth wave is on, now caution advised at higher lvls.

exit lvl will be given in the next post.

Posted by

abhay r somkuwar

at

9:22 AM

6

comments

![]()

Monday, August 24, 2009

tentative nifty intraday ew chart...

my tentative nifty spot counts till 1:30 pm on 24th aug 2009, do not trade on this as the counts are speculative.

Posted by

abhay r somkuwar

at

1:24 PM

3

comments

![]()

mkt ahead 24th aug 2009...

as mentioned nifty opened weak on friday and took support again near the imp 4400 lvl to bounce back and reached our given tline resis lvl of 4538, good intraday trading opportunity.

on eod charts its still rangebound in a falling wedge shaped consolidation pattern. supports 4423 and 4348. brkout point on upperside for monday 24th aug 2009 is 4520, crossing 4538 a minor resistance is at 4558 and major ones at 4600 and 4620.

if confirmed and decisive closing basis brkout takes place from upper or lower limits(4520/4348) then tgts from this consolidation may be of magnitudes 215/266/360 points.

here's another angle: brkout from ascending triangle on intraday nifty chart.

mkt likely to open in the green.

Posted by

abhay r somkuwar

at

1:57 AM

0

comments

![]()

Friday, August 21, 2009

rangeboundness!

nifty ranged between two falling tlines in last many days(refer charts posted in earlier post).

todays limits on the tlines are 4538 on upper side and 4348 on the lower side of the range.

larger range is 4300-4700.

medium to intermediate positions still long as the uptrend has not broken. fresh positional traders can initiate only on brkout from either side to avoid any whipsaw or getting sl hit, but one or two good opportunities are there for intraday each day.

opening expected weak today.

Posted by

abhay r somkuwar

at

9:49 AM

6

comments

![]()

Tuesday, August 18, 2009

market ahead 18th aug 2009...

mentioned 4510 below which nifty is weak, 4380-88 was said as support area closing basis for medium trend.

trading closing below 4350(fut) can take it to next lvl of near 4200 etc.

today and couple of days trading is very imp what mkt is going to do next, its in short term downtrend but closed just near the very imp medium to intermediate uptrend decider lvl/tline.

the supports and resis and fibo lvls etc with negative divergences, macd and ma crossovers with volume etc are as shown in the charts below.

Posted by

abhay r somkuwar

at

8:10 AM

0

comments

![]()

Blog Archive

-

►

2019

(2)

- ► 31 March - 7 April (1)

-

►

2017

(5)

- ► 28 May - 4 June (1)

- ► 23 April - 30 April (1)

- ► 5 March - 12 March (1)

-

►

2014

(4)

- ► 9 March - 16 March (1)

-

►

2012

(8)

- ► 20 May - 27 May (2)

- ► 13 May - 20 May (2)

- ► 6 May - 13 May (1)

- ► 29 April - 6 May (2)

-

►

2011

(42)

- ► 31 July - 7 August (1)

- ► 17 July - 24 July (1)

- ► 10 July - 17 July (1)

- ► 3 July - 10 July (1)

- ► 26 June - 3 July (2)

- ► 19 June - 26 June (2)

- ► 22 May - 29 May (1)

- ► 15 May - 22 May (1)

- ► 8 May - 15 May (1)

- ► 24 April - 1 May (1)

- ► 17 April - 24 April (2)

- ► 10 April - 17 April (2)

- ► 3 April - 10 April (3)

- ► 27 March - 3 April (3)

- ► 20 March - 27 March (1)

- ► 6 March - 13 March (2)

-

►

2010

(69)

- ► 18 July - 25 July (1)

- ► 11 July - 18 July (1)

- ► 27 June - 4 July (1)

- ► 20 June - 27 June (1)

- ► 13 June - 20 June (1)

- ► 6 June - 13 June (1)

- ► 30 May - 6 June (1)

- ► 16 May - 23 May (1)

- ► 9 May - 16 May (2)

- ► 2 May - 9 May (3)

- ► 25 April - 2 May (2)

- ► 18 April - 25 April (2)

- ► 11 April - 18 April (2)

- ► 4 April - 11 April (3)

- ► 28 March - 4 April (3)

- ► 21 March - 28 March (1)

- ► 14 March - 21 March (2)

- ► 7 March - 14 March (2)

-

▼

2009

(146)

- ► 2 August - 9 August (4)

- ► 26 July - 2 August (4)

- ► 19 July - 26 July (7)

- ► 12 July - 19 July (3)

- ► 5 July - 12 July (3)

- ► 28 June - 5 July (2)

- ► 21 June - 28 June (3)

- ► 14 June - 21 June (3)

- ► 7 June - 14 June (2)

- ► 31 May - 7 June (2)

- ► 24 May - 31 May (1)

- ► 17 May - 24 May (4)

- ► 10 May - 17 May (6)

- ► 3 May - 10 May (4)

- ► 26 April - 3 May (1)

- ► 19 April - 26 April (2)

- ► 12 April - 19 April (2)

- ► 5 April - 12 April (3)

- ► 29 March - 5 April (3)

- ► 22 March - 29 March (4)

- ► 15 March - 22 March (2)

- ► 8 March - 15 March (4)

- ► 1 March - 8 March (4)

-

►

2008

(108)

- ► 27 July - 3 August (2)

- ► 22 June - 29 June (2)

- ► 15 June - 22 June (2)

- ► 8 June - 15 June (3)

- ► 1 June - 8 June (3)

- ► 25 May - 1 June (1)

- ► 18 May - 25 May (2)

- ► 11 May - 18 May (3)

- ► 4 May - 11 May (1)

- ► 20 April - 27 April (2)

- ► 9 March - 16 March (1)

-

►

2007

(92)

- ► 29 July - 5 August (9)

- ► 22 July - 29 July (2)